Timber pricing cycles

Looking after your bottom line is always a priority for builders, but with the cost of materials on the rise, this is often easier said than done. This article examines the global cycles of structural timber use and pricing and what builders may expect from local suppliers that are affected by international variations.

Recently I sat down with some major builders and property developers to discuss structural timber pricing cycles and the dilemma that many wood products and timber producers face in dealing with global supply dynamics that have influence on timber pricing in Australia.

“Timber is a crucial material for lightweight construction in our medium rise apartment buildings and represents a major cost item,” Australand Property Group estimating manager Kase Jong says.

“Australand’s objective is to provide attractive and cost-efficient structures that create affordable housing and the use of timber is an important component of reaching that objective, so we need to be kept informed of any likely changes well in advance.”

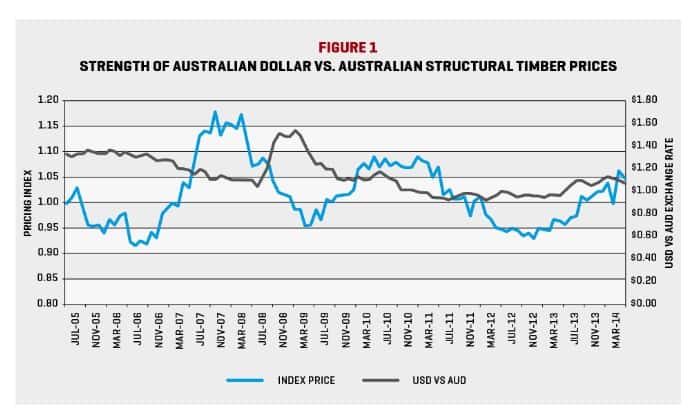

Local structural timber prices are cyclical and for a long time have closely followed the dwelling construction cycles, but in the past few years pricing has been influenced by global currencies which have favoured imports from Europe.

This connection between the Australian dollar value and structural timber prices has changed the traditional cycle, and can be seen by the graph of the USD vs. AUD and the structural timber price index (see Figure 1).

Structural softwood imports have increased to about 20% of the overall supply in Australia, so with this high market share our structural timber prices are now much more exposed to the world market dynamics.

Increasing demand in the Northern Hemisphere, especially North American housing demand and emerging markets such as China, are now showing steady growth which has resulted in pricing increases around the world.

Global industry commentators have predicted that a lumber ‘super-cycle’ combination of high demand for lumber and shortage of supply suggests international prices will soon go up due to the brisk upturn in the U.S. housing market and rising world demand.

The ‘super-cycle’ has been discussed as being imminent for the past six years, but only now with the recent world economic recovery and rise in U.S. housing has it appeared that conditions will be ripe by the end of 2014.

Australia is now part of a global business and no longer isolated from international trends in supply and pricing, which now exposes the timber pricing cycles to influences other than traditional housing cycles and currency fluctuations.

“Pricing is a difficult issue for builders, with long periods between customer deposits, contract signing and the building start, due to issues outside of the direct control of the builder. The problem is the cost estimates at sale and the real costs when building can be significantly different,” Metricon Homes procurement and supply chain manager Matt Gaunson says.

“To reduce the impact of cost increases we expect suppliers to be solution providers, not just another link in the supply chain, and there are many examples of improvements in the channels to market that realise savings for all parties.

“A major area of efficiency improvement is the number of ‘touch points’ received by building products in the handling process from manufacture to warehouse, to distributor, to supplier, to builder, to building site. If the number of steps can be reduced the outcomes are greater efficiency and lower costs.”

Henley Homes Victorian business manager Simon Gough commented: “We want the market to be a level playing field, with any pricing changes applied equally across the board.

“A good example was the introduction of 5 Star ratings, which Henley strongly supported to improve energy efficiency. As it was applied to the whole building industry we were not disadvantaged even though there were cost increases.

“We support investment in the local timber industry and want them to remain viable, so price increases are inevitable, but they also must be affordable and realistic.”

For some years Australian timber producers have experienced low prices for structural timber products not keeping up with inflation, while production costs have continued to rise.

This has resulted in greater investment for improved productivity in manufacturing to achieve a financial return, but it has not been adequate for an appropriate return on the large amount of capital required.

Continuing investment to improve efficiency and productivity is required for a financially sustainable Australian timber industry, with returns above current levels needed to maintain vital economic growth and rural community employment.

Building trends are also part of this economic rationale, with the use of timber enabling cost savings by moving labour to off-site manufacturing by pre-fabrication, and from faster construction to reduce time and site costs, resulting in improved financial returns to developers and builders.

Overall, the future for structural timber and engineered wood products is very bright with global and local trends to use more timber framed and panelised structures to lower building costs in construction of detached housing, multi-residential and commercial buildings.

These building and pricing trends are now underway, and the complete supply chain will need to adapt by encouraging greater efficiency and flexibility in cost structures for supply of timber and building materials to the process of construction.

Kevin Ezard provides business communication and marketing consultancy services to the timber and wood products industry, and organises the Frame Australia Conference and Exhibition.