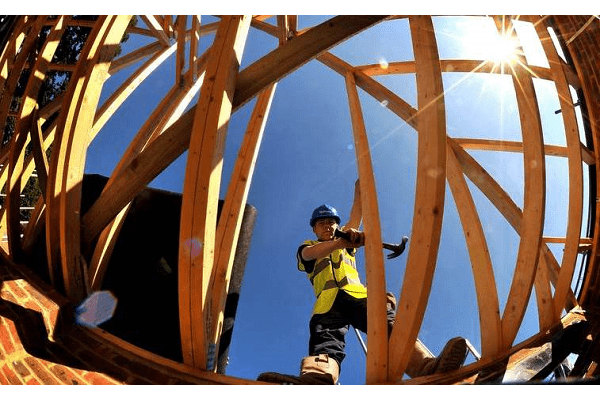

Budget helps building and construction industry

The recently released Budget is expected to boost the confidence among members in the building and construction industry.

“Building and construction investment is a major driver of the improvement in the Budget position,” says Master Builders Australia chief executive Denita Wawn.

“Reducing the tax burden on households and small business is good for the economy and good for builders. People may decide to renovate their kitchen sooner or buy their first home faster.

“It’s also great news that our many small builders who are sole traders will also get tax relief in this Budget.

“Master Builders called for more certainty for state and territory governments to sign up to the $1.5 billion Skilling Australians Fund (SAF) and the Government has listened. The SAF will focus on funding for new apprentice training initiatives, that are no longer conditional on a levy of skilled migration.”

$250 million is available for state and territories in this financial year, a share of $50 million is available for governments that sign-up to the SAF prior to June 7 and $50 million per year over four years is available to states and territories who are signed up to the SAF.

“The Government’s infrastructure Budget will play a key role in setting the nation up for future prosperity.The additional $24 billion investment in infrastructure across the country will boost the productivity and liveability of our cities,” says Denita.

“Small businesses will benefit from the extension of the $20,000 immediate tax write-off scheme until 2019. There are more SMEs in buiding and construction than any other industry and this great news for mum and dad building business and tradies.

“The uncorporated small business tax discount rate will increase from 5 per cent to 8 per cent allowing SME builders to write-off their assets faster.”