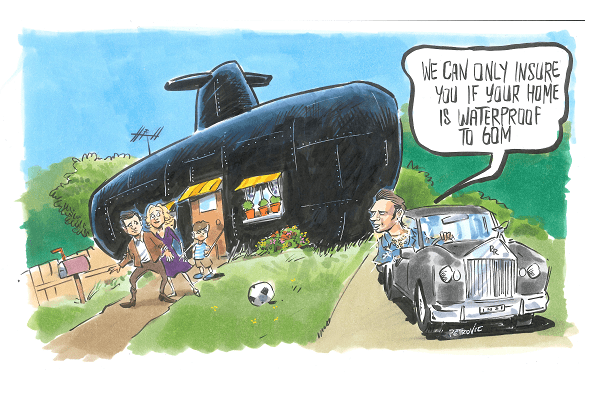

Covering all bases of home insurance

Are insurers fair-weather friends? Jerry Tyrrell sets out the issues and puts forward solutions.

Most insurers I know have paid out claims even when they did not have to, which is to be commended.

However, I want them to make a good profit by having to repair less because owners are smart – or get smart advice. This is the challenge.

I have seen lots of claims in which the damage was trivialised, not fixed properly or denied until the last minute when the threat of media involvement persuaded the insurers to be more helpful.

I look at a lot of buildings, very few of which are perfect but most are OK. They usually keep the occupants safe and dry. And I am an advocate for building insurance, which includes ‘storm and tempest’ cover.

This means insurers will pay for unavoidable storm damage to your home – or will they?

The fine print in some policies allows the insurer to deny your claim if water is blown through gaps in your building. Even some lawyers think this is reasonable. Well, I don’t.

There are so many points at which wind-forced rain from just the right angle will enter your building.

You can see daylight in most roofs – due to corners or Dutch gables, edges of flue flashings or slightly displaced tiles. These hardly ever cause problems. Of course, there can be poor workmanship that I will ask the contractor to fix, for example tops of sheets not weathered or no back pan behind a skylight.

So I urge insurers to absorb what we builders know. We follow best practise, but joints between materials will result in gaps. Complex design such as hexagons, curves and butterfly roofs lead to even more leak points.

To be worthwhile, insurance needs to cover the owner for any water entry and damage at these points of a building.

Getting more value

We all contribute through premiums if an expensive claim occurs.

So insurers could afford to offer more cover if there were no payouts for easily prevented damage – blocked box gutters, broken roof tiles, slipped parapet flashing, etc. And insurers should not have to pay in these cases:

- tree limb damage when it was obvious that a branch was dead and dangerous;

- 50-year-old galvanised pipe springing a leak in the roof while the owners are on holiday; or,

- owners allowing trees and combustible plants to become a ‘forest’ close to the building.

Overall payouts can be reduced, and the savings should be used to enhance insurance products. Insurers could provide vital support when good clients are not fully covered.

Insurers might even pay a spotter’s fee to builders for fixing something that would have caused an insurance claim – moss on sandstone pavers, insufficient bracing on a carport, or poor installation of an air conditioner allowing access over a pool fence.

Insurance companies provide a safety net. However, recognising essential maintenance will save the nation billions of dollars of unnecessary damage resulting from the inevitable storm, fire or wild party. Insurance companies can bring this about by engaging our industry people and using their knowledge.

Builders are able to help owners and could allow insurance companies to be all-weather friends.

Let me know any thoughts at jwtyrrell@tyrrells.com