Australian PCI: COVID-19 lockdowns plunge construction into steep contraction

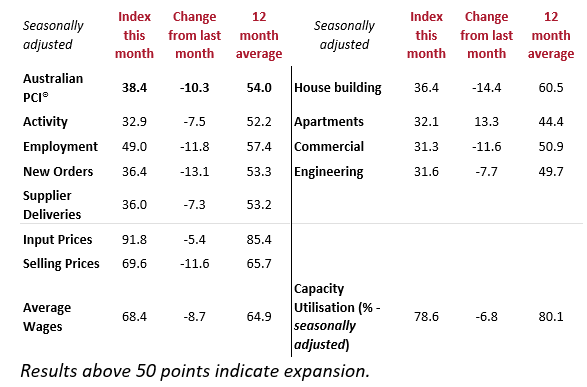

The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index (Australian PCI) contracted by a further 10.3 points to 38.4 in August – a second and more severe month of contraction following a significant decline in July (readings below 50 indicate contraction in activity, with lower results indicating a stronger pace of contraction).

The indexes for activity, new orders and supplier deliveries in the Australian PCI dropped steeply into contraction in August, in response to strict activity restrictions in the construction sector in Victoria and NSW, and state border closures that are affecting the industry’s supply chains nationwide.

“Australia’s construction sector has shifted from healthy expansion to steep contraction in a flash as restrictions in the face of COVID-19 outbreaks have closed sites and disrupted supply chains. The impacts were concentrated in the south-east corner of the country although border closures by other states also contributed to supply chain disruptions and prevented the movement of construction personnel,” Ai Group chief policy advisor Peter Burn says.

“Nevertheless, beyond the south-east corner aggregate construction activity avoided contraction. Nationally, all four construction sectors suffered drops in activity in August with the house building sector joining apartment building and commercial and engineering construction in negative territory. Employment slipped slightly in August with builders and construction businesses mindful of recent difficulties in filling positions, hesitant to put staff off. Input price pressures continued into August although the pace of increase eased with lower levels of activity.”

He adds that new orders fell precipitously – a pattern evident across the four construction sectors and, in combination with continuing restrictions, pointing to the likelihood of further contraction in September and October.

“Lockdowns have brought the industry to a standstill and are eroding builders’ confidence. The Australian PCI was dragged even further into negative territory in August after activity began contracting in July,” HIA chief economist Tim Reardon says.

“Even activity in home building specifically, started going backwards in August for the first time in almost a year. The industry was not permitted to operate like it did during previous lockdowns, despite its exceptional record of operating safely throughout the pandemic, consistent with COVID safety measures.

“While this does stretch out the HomeBuilder boom for longer, it carries with it significant costs. Builders can’t work from home. Households that can’t move into their incomplete new homes are saddled with the financial stress of ongoing rent or mortgage payments. Government coffers and the broader economy also suffer from the loss of this very valuable activity. Apartment activity is also still contracting in the absence of overseas migrants, students and tourists.”

Australian PCI – Key Findings for August:

- The activity indexes for all four sectors in the Australian PCI were well under the 50-point level separating expansion from contraction in August, with big falls in NSW and Victoria due to lockdown disruptions. The biggest drops were in the housing (down 14.4 points to 36.4) and commercial construction (down 11.6 points to 31.3) activity indexes, which both recorded a second month of contraction. The apartment building activity index rose by 13.3 points to 32.1 – still far from its expansionary state in June.

- The Australian PCI index for new orders fell sharply in August (down 13.1 points to 36.4), indicating serious contraction. Some builders reported lower enquiries from potential customers and less interest in joining waitlists. The supplier deliveries index indicated a second month of contraction and at a faster rate in August (down 7.3 points to 36.0) as builders across all sectors and locations reported delivery delays and high freight prices.

- The indexes for input prices (down 5.4 points to 91.8) and selling prices (down 11.6 points to 69.6) indicated some deceleration in price rises in August but remain elevated. Builders nationwide continue to report very high prices from suppliers and importers, with more builders saying they need to pass on these cost increases to their customers.

- The employment index dipped just below 50 points in August (down 11.8 points to 49.0), indicating a pause in the jobs recovery underway earlier in 2021. The wages index fell 8.7 points to 68.4 following a recent peak in July (which reflected new minimum wage and award rates from 1 July). Builders continue to report wage pressures arising from skill shortages.