Australian PCI: Construction sector shrinks for fourth month

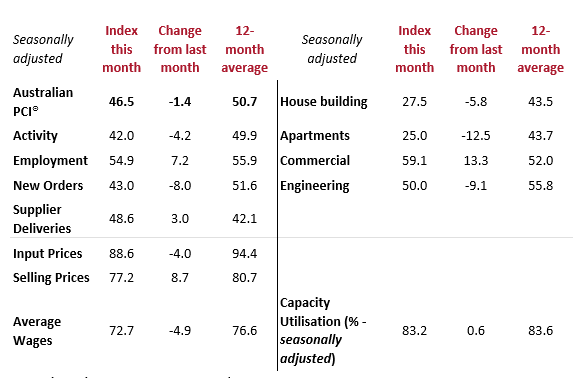

The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index (Australian PCI) fell by 1.4 points to 46.5 in September, indicating a contraction in activity across the construction sector for a fourth month, and at an increased rate of decline compared to August.

Ai Group chief policy advisor, Peter Burn, says that new activity and new orders were both lower than in the previous Australian PCI.

“Performance was uneven across the industry with activity in the residential sectors worsening at a faster pace while commercial construction lifted and engineering construction was flat. Employment on the other hand was higher and capacity utilisation edged higher,” he says.

“While input and selling prices and wages continue to rise, all three measures indicate a lower rate of increase than their average levels over the past year. Higher interest rates are clearly negatively impacting the residential sectors, and the lagged impact of recent increases is likely to drag these sectors lower over the coming months as suggested by the sharp fall in new orders in these sectors. Against this background, the Reserve Bank’s decision to slow the pace of its normalisation of interest rates will be of some comfort to house and apartment builders.”

Key Findings for September 2022 (readings below 50 indicate contraction in activity, with lower results indicating a stronger rate of contraction):

- Two of the four construction sectors – housing and apartments – were in deep contraction in September. Activity improved in the commercial sector and was stable in engineering.

- Demand side pressures, including rising interest rates and economic uncertainty, are dampening consumer-facing construction sectors from elevated levels seen during the pandemic.

- Supply side constraints continue to inhibit growth, but there are early signs of supply chain pressures easing. Construction employment also improved.

- The selling prices indicator grew again to 77.2. While input prices fell slightly, at 88.6 the indicator remains higher than selling prices.

- Capacity utilisation rose slightly to 83.2%; it has been sustained at highly elevated levels since the end of 2020.

“Recent RBA interest rate increases are clearly having a negative impact on demand in the residential construction industry,” HIA senior economist Nicholas Ward says.

“Australian PCI data indicate new orders for houses have contracted sharply in recent months. But because builders built up a large pipeline of work during the pandemic, it will take a significant period for weaker demand to translate into weaker activity on the ground. Capacity utilisation amongst builders remains at very elevated levels, as they work through the pipeline.”