Construction business leaders confident despite national insolvency crisis

Survey results revealing an industry outlook have shown the majority of construction business leaders, at 83%, view the industry as ‘stable’ and able to withstand pressures to continue growing. At the C-suite level, this number increases with almost nine in ten agreeing that the industry is stable.

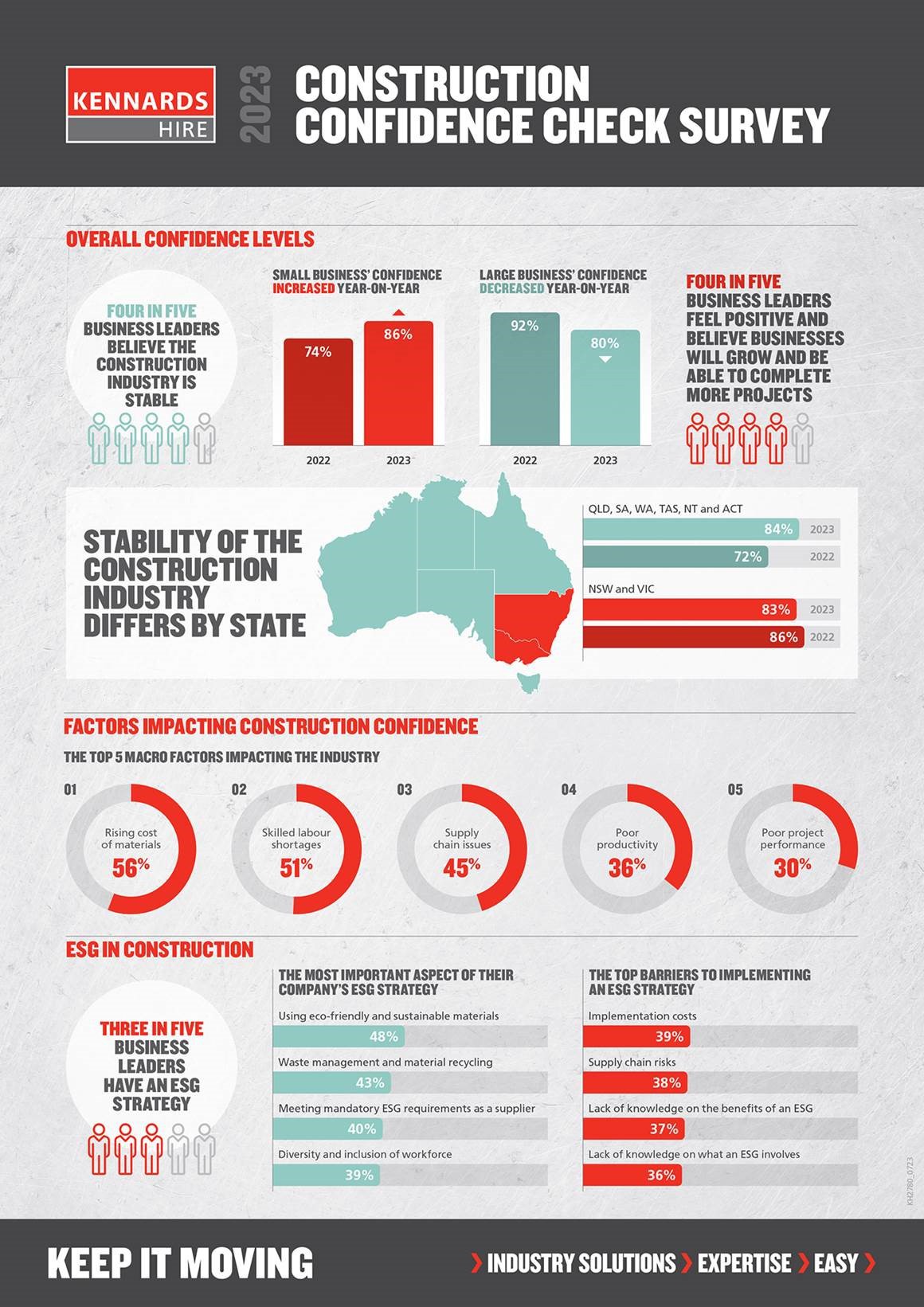

The 2023 Kennards Hire Construction Confidence Check surveyed over 500 of Australia’s business leaders in the construction industry with more than 20 employees. The findings demonstrate how boardrooms are faring in the current environment, highlighting perceptions of small and large businesses operating in the industry.

“The Construction Confidence Check allows us to stay attuned to the industry’s outlook, ensuring we remain well-informed and can continue to use our expertise to help businesses navigate mounting pressures,” Kennards Hire general manager Tony Symons says.

Compared to last year’s Construction Confidence Check, while overall confidence in Australia’s construction industry has improved, this year’s survey results indicate a sentiment shift based on business size and location.

In smaller businesses, from 20 to 99 employees, confidence in 2023 has increased to 86%, up from 74% in 2022, while in larger businesses, with over 100 employees, confidence has seen a decline, dropping from 92% in 2022 to 80% in 2023.

A slight decline in confidence has also been shown in NSW and VIC with 83% in 2023, compared to 86% in 2022, while the rest of Australia has shown an increase in confidence with QLD, SA, WA, TAS, NT and ACT rising to 84% in 2023 from 72% in 2022.

“Australia’s construction industry is resilient and adaptable, so it’s no surprise that most business leaders are hopeful about the future. Based on our survey results and conversations with industry leaders, we know the difficulties experienced by some construction businesses do not define the entire sector,” Tony says.

“However, we also know that many are still feeling the impact of external factors. In fact, our survey shows that 56% of business leaders say rising costs of materials is their top issue impacting confidence in the industry, followed by skilled labour shortages, at 51%, and supply chain issues, with 45%.”

To achieve stability and growth in the construction sector over the next five years, construction business leaders surveyed ranked solving the rising cost of materials at 50%, skilled labour shortages at 42% as well as the rising cost of equipment and supply chain issues with at 40% and 37% in the top macro issues to solve for.

The survey also explored industry perceptions on ESG, revealing that Construction business leaders are taking their ESG responsibilities seriously with 59% saying their company has an ESG strategy in place and, of those who have an ESG strategy in place or are looking to implement one, 48% say the use of eco-friendly and sustainable materials is a step they are taking to improve ESG outcomes, closely followed by proper waste management and material recycling at 43%.

In addition, of those who do not have an ESG strategy in place, common barriers to further progressing their ESG strategy include costs at 39%, supply chain risks at 38%, lack of knowledge and understanding of how an ESG strategy can benefit their business with 37% and a lack of knowledge and understanding on exactly what an ESG involves at 36%.