Work continues to surge for small residential builders amidst COVID-19 pandemic

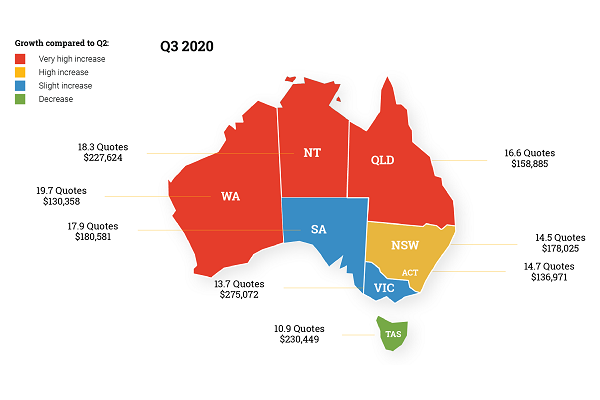

Small residential builders in Australia continued to experience strong demand for new builds and renovations in the September quarter (Q3) of 2020 despite a COVID-19-related slowdown in Victoria, according to data from residential construction management software company Buildxact.

Buildxact’s Residential Construction Activity Report July-September 2020 shows that nationally, demand for new builds and renovations in Q3 2020 (July – September) has exceeded Q2 2020 (April – June). The software company also saw its subscriber numbers rise by 21% in Q3 with the volume of quotes exceeding that figure.

Over July-September 2020, Buildxact subscribers quoted on $5.6 billion worth of projects, compared to a total of $3.91 billion in Q2 (April – June) 2020 – an increase of 42.7%.

This growth is not only good for the many builders, but the broader construction industry. Based on an average number of jobs won per small residential builder of 17%, the $5.6 billion of quotes over Q3 is expected to convert to $952 million of new project work. Of this, approximately 40%, or $381 million, flows through to hardware purchases.

“Hardware suppliers may see significant purchases orders in the months towards Christmas,” Buildxact chief executive David Murray says.

Building supplier Dahlsens chief executive Geoff Dahlsen says that for the most part, the builders are faring well during the pandemic, especially those in regional areas.

“The change to remote working has created a ‘flee change’ where people are fleeing the cities and moving to regional areas,” he says.

“Their money can go further here, so people are buying existing houses and renovating. The HomeBuilder grant has had a positive impact, and now the low interest rate has created more incentive for people to get into the market, so I’m confident we’ll continue to see strong demand for the next six months.”

The average value of quotes over Q3 2020 rose in July and August and hit a peak for the year-to-date in September, at $175,711 according to Buildxact.

The win rate and average number of jobs won per small residential builder has remained steady, with builders winning around 17% of jobs quoted. Further, profit margins rose in Q3 (three-month average 14.2%) compared to Q2 (three-month average 13.8%), reflecting greater demand.

“There’s so much demand out there that some small residential builders are being run off their feet. Our subscriber numbers continued to rise during the September quarter, but it’s still well outpaced by the growth in demand,” David adds.

“As people have been restricted with domestic and overseas travel and are needing to spend more time at home, many are choosing to put their holiday budget towards renovations and home improvements instead.

“Growth in profit margin suggests that builders have sufficient work and are not under pressure to reduce prices. Profit margin is also helped by the fact that there is more demand for renovations than new builds. Renovations attract a higher margin.”