Probuild collapse – a tragedy that could have been avoided

Following the news that Australian construction industry giant Probuild has fallen into voluntary administration, leading credit reporting agency CreditorWatch assessed the warning signs that existed in advance of the collapse and how they could have been avoided.

“This news comes as a devastating hit to the Australian construction industry,” CreditorWatch chief executive Patrick Coghlan says.

“The demise of a business with the scale and reach of Probuild is bound to send shockwaves through the industry, as thousands of small businesses are impacted. Sadly, I fear this is the tip of the iceberg, and we could see many more going under, as an industry that was already under significant pressure is dealt another heavy blow.”

Red flags in plain sight for industry partners

The writing was on the wall for Probuild which, like the rest of the construction industry, struggled to survive a perfect COVID storm of supply chain disruptions, cost blowouts and increased worker absenteeism.

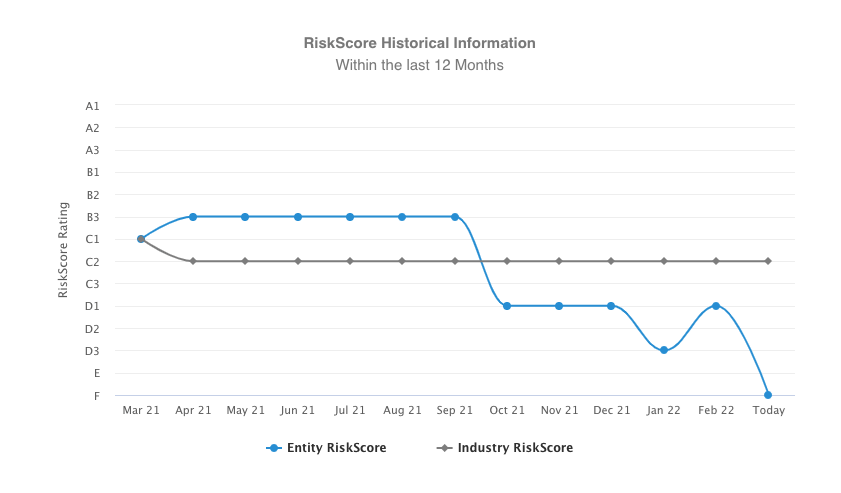

CreditorWatch listed Probuild under a D1 or D2 RiskScore Rating from October 2021, with its risk of default or insolvency significantly higher than the average Australian business. This score was awarded based on a variety of factors, including the rapid increase in credit enquiries from August 2021 onwards.

“The data underlines just how crucial it can be for small businesses to monitor the vital signs of their stakeholders and to identify those suppliers and debtors that could be at risk of default, in order to adequately assess their credit risk,” Patrick adds.

In the past five years, Probuild had 1,588 credit enquiries, of which 545 were lodged in the last 12 months alone. This increase is in line with the wider construction industry, which currently sits at the top of the ANZSIC Division for credit enquiries on 255, well above manufacturing on 75 and Professional, Scientific and Technical Services on 58.

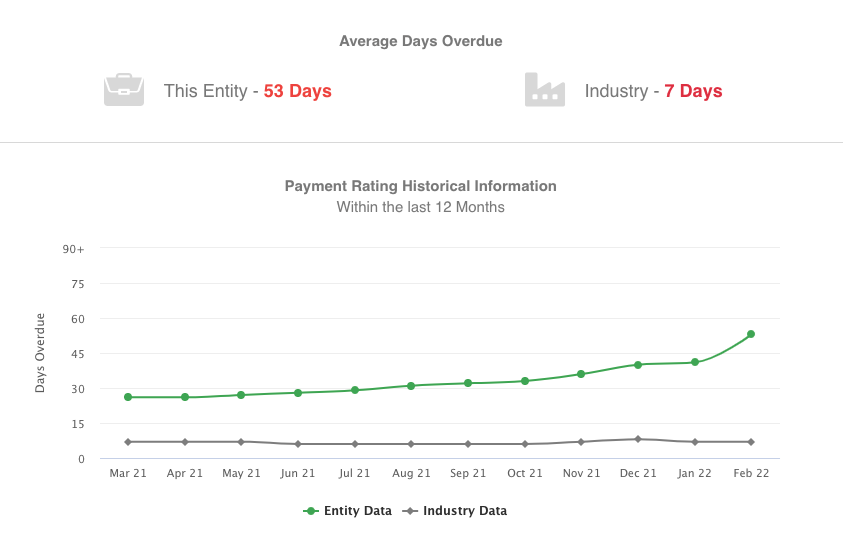

Probuild’s average repayment time also increased substantially in 2021, rising from just under 28 days in March 2021 to 58 days in February 2022. This spike clearly contrasts with the wider industry, which as a whole experienced significant challenges throughout the pandemic, but maintained an average repayment time of seven days in both 2021 and early 2022.

Another red flag was the three court actions lodged against Probuild, two of which came in quick succession in October and November 2021. This marked Probuild as ‘high risk’ on CreditorWatch

“The fundamental reasons for failure are the same as they always are; albeit some, but certainly not all, blame can be attributed to COVID. The usual reasons are under capitalisation and underquoting with both labour and supplies. Add to those this time the supply chain going to hell in a handbasket,” Advisory Services Australia general manager Ginette Muller says.

Will the fall of Probuild cause a construction administration avalanche?

Probuild is the largest casualty of Australia’s increasingly pressured construction industry, but is not the first major construction business to fall in 2022. Melbourne-based ABD Group went into liquidation with creditors believed to be owed $50-$80 million. Brisbane-based Privium also went into voluntary administration with estimated debits of $28 million.

The collapse of three major players since the start of 2022 aligns with findings from CreditorWatch’s January Business Risk Index, which found the number of businesses with the largest proportion of payment in arrears by 60 days or more belonged to the construction industry at 12.4%.

Is this just the tip of the iceberg for the construction industry?

The construction industry has been particularly hard hit by the pandemic and is consistently flagged by CreditorWatch data as one of the industries at greatest risk of default. Data from February’s Business Risk Index showed that construction was the worst offender for payment arrears, with 12.4% of businesses in this sector in arrears of 60+ days, driven by the industry’s unique payment structures which are contributing to a high rate of arrears.

According to Insolve convenor James Flaherty: “The Probuild collapse shows we are past the ‘canary in the coal mine’ stage of impending trouble in the sector. There will not only be a knock-on effect from other businesses being taken down by this collapse, but it’s also indicative of a broader problem in the construction industry”.

CreditorWatch chief economist Harley Dale comments: “The construction industry was arguably facing tough times before COVID, with the pandemic exacerbating those existing pressures. Companies were stretched in 2018/19 and over 2019/20 and then 2020/21 blew things out of the water. That situation persists today.

“There’s no doubt a great number of commercial construction companies are under the hammer right now and what happened to Probuild has an adverse impact on confidence and on the ability of businesses to access any required additional finance, which is likely to become a prominent issue in 2022.

“What the Probuild demise reminds us is that the ‘new world’ 2022 doesn’t work for businesses with legacy issues, and what is happening to Probuild may be a portent for darker times ahead for the commercial construction industry.”