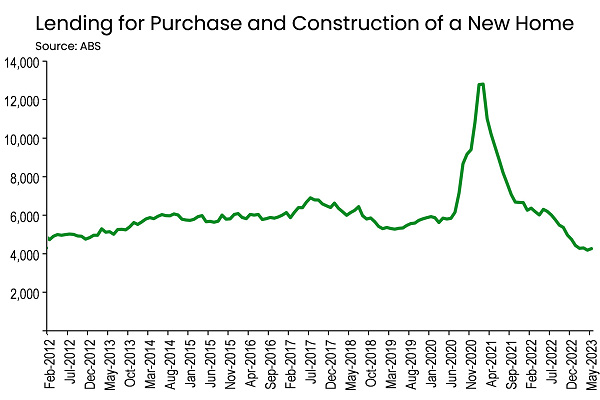

Home building lending hits record low

Home building levels of lending have hit a record low, resulting in the commencing of new home construction continuing to decline.

The record comes with the release of the Australian Bureau of Statistics’ (ABS) ‘Lending to Households and Businesses’ data for May 2023, as well as the same month’s building approvals data for detached houses and multi-units covering all states and territories.

“There were only two other occasions in the last 20 years when these numbers were so low, the introduction of the GST and for a brief period during the outbreak of the GFC,” Housing Industry Association (HIA) chief economist Tim Reardon says.

“The number of loans issued for the purchase or construction of a new home increased by 1.9% in May which still leaves the last three months 31.1% below the same quarter a year ago. Lending for the purchase of residential land remains 20.2% lower than at the same time the previous year.

“With the full impact of the rise in the cash rate still to flow through to these official figures, they are likely to remain supressed for an extended period of time.”

In seasonally adjusted terms, the total number of building approvals in the three months to May 2023, compared to the same quarter a year earlier, declined in almost all jurisdictions, with Western Australia leading at -25.9% and Victoria at -25.8%, followed then by Queensland with -18.7% and South Australia with -11% before Tasmania placing with -8.6%.

New South Wales saw the only increase being up by 15.8% on the back of a spike in multi-unit approvals in May. However, in original terms, declines were also seen in the Australian Capital Territory at -60.4% and the Northern Territory at -24.1%.

“The RBA’s cash rate increases over the last year have seen owner occupiers and investors, alike, retreat from the market. Earlier projects are also being cancelled as banks withhold finance in the wake of interest rate and construction cost increases,” Tim says.

“This lack of new work entering the pipeline means the number of projects that builders have sold but not yet commenced, is shrinking rapidly, and far fewer new homes will be commencing construction by the end of the year.

“Building approvals are expected to continue to slow until early 2024 given the low volume of sales and lending for new homes recorded this year.”