3 0

BUILDING CONNECTION

SUMMER 2016

the growth of the “super” builders like Simonds, Henley,

Metricon etc. who have now become national players and

who have developed around 60% of the new smaller builders

who cut their teeth at one of these companies. These guys

knew what prices they were paying for products and when

they moved or started on their own they expected the same

rates.

The biggest issue in the southern states is the domination

of the roofing industry by roof tiles. Roofers can afford to

accept minimal margin on a lead in product like fascia and

gutter if they also get the roofing to balance it out but no

one can afford to take that kind of a hit if the roof is tile.

BlueScope has been looking at ways to raise the

percentage of metal roof installs in these southern states

but have been fighting a winless battle. Over the last 10

years all of the major roof tile manufacturers have tried to

buy or develop their own fascia and gutter companies and

these massive conglomerates with all of their resources

have failed or walked away... why? Because there is no profit

in it, but we, the roofing companies, allow it to continue

without raising the prices of metal fascia and gutter.

For a start, if a roofer is installing metal fascia and gutter

on a house with a tile roof, the price should be 30% higher

than for a metal roof and there are three reasons why:

1. Tiles are so much heavier and result in more maintenance

2. When you are doing the roof you have more visibility on

the job and can rectify any issues before finishing it

3. Because you can.

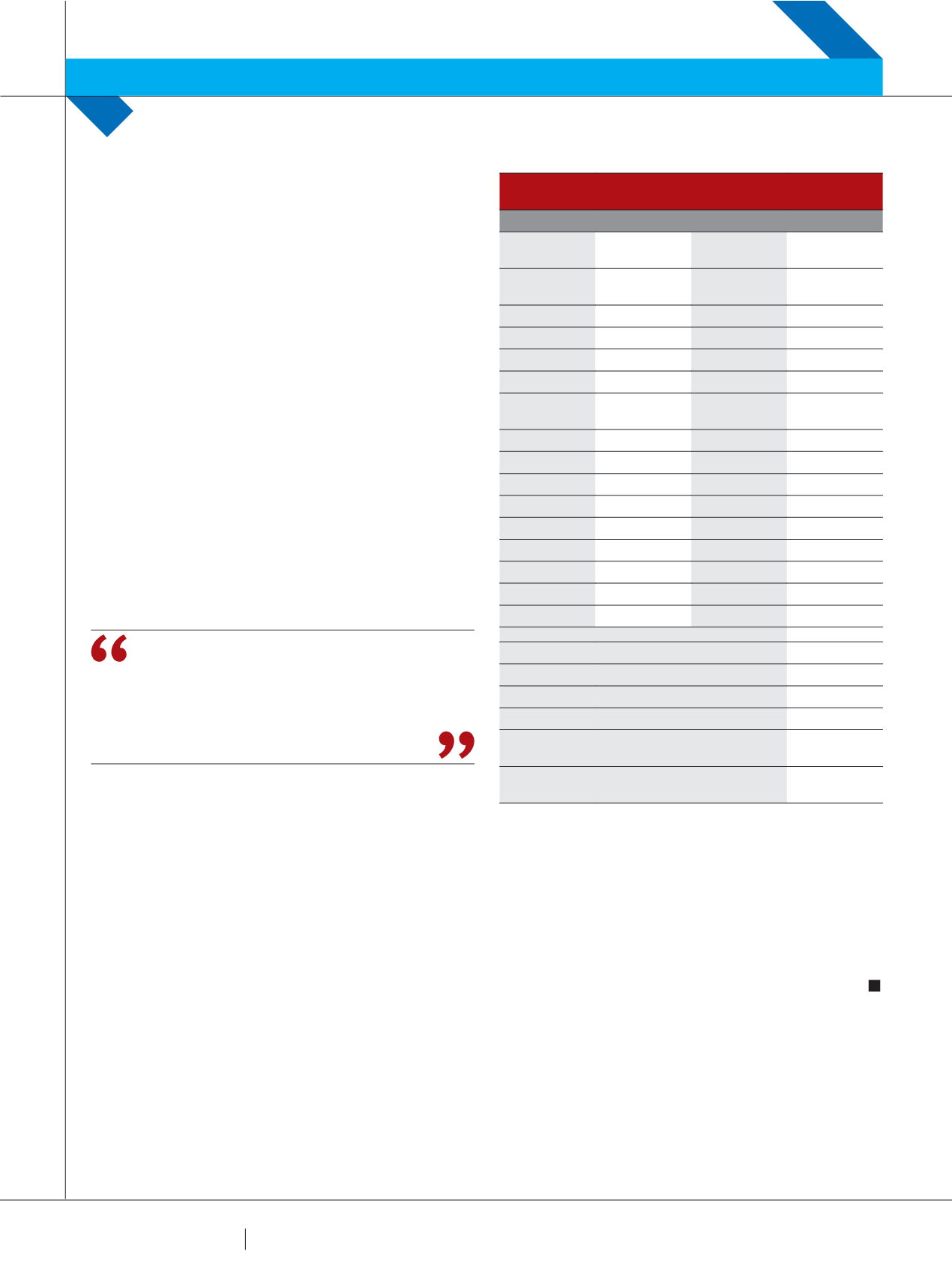

This is what the calculations could/ should look like:

(Please See Table 3)

As I write this we have just received notification that

BlueScope is raising its rates again in October/ November

by 5.5-7.6%. Installers cannot continue to absorb these

increases and if they do, the likelihood of them becoming

insolvent is very high. And to be honest, it’s very neglectful

to their customers, the builder, the builder’s customer,

the home owner and the industry as a whole because

there are installers out there who are either unaware of

this happening or cutting corners to stay profitable and

installing an inferior product. When these products fail, and

TABLE 3 - WHAT COLORBOND F&G SHOULD BE

COLORBOND FASCIA & GUTTER (BASED ON AVG 80 L/m)

PRODUCT

QUANTITY

PRICE PER PRICE PER L/m

Colorbond

Fascia

80

$4.50

$4.50

Colorbond

Quad

80

$4.50

$4.50

Rafter Bracket

133.33

$0.80

$1.33

Stiffiner

88.89

$0.80

$0.89

Spring Clip

88.89

$0.80

$0.89

Apex Spacer

88.89

$0.25

$0.28

Internal Fascia

Plate

2

$2.65

$0.07

External Mitre

6

$3.70

$0.28

Barge Mitre

2

$3.70

$0.09

100 x 50 Pop

7

$2.19

$0.19

Cast Angle

10

$10.96

$1.37

Stop Ends

2

$2.51

$0.06

Silicone

1

$4.30

$0.05

Riverts

200

$0.09

$0.23

Bugle Screws

400

$0.02

$0.03

Labour

1

$7.00

$7.00

Supply and Install Cost Per M2

$21.76

Overhead of 15%

$3.26

Supply and Install Cost Total Per L/m

$25.03

Sell to customer per Lineal meter

$35.04

Standard Profit per lineal meter based on

install rate of $27.00l/m

$10.01

Profit percentage per lineal meter based on

install rate of $27.00l/m

40.00%

Contact:

Peter knows his metal roofing with 20 years of experience

in design, manufacture and installation. He is the general

manager of Johnson Roofing, which supplies and installs

metal roofing to projects throughout Victoria. Peter is also

currently the director of the Residential Metal Roofing

Industry Association of Victoria.

If you have any questions:

peter@johnsonroofing.com.authey will, they will not be there to fulfil the warranty and the

insurance company will have to foot the bill.

I believe that the building industry has changed so much

over the last 30 years, as has the society we live in, and the

product/service we deliver should be improving, rather than

declining and we need to make it attractive for people to

want to join our industry. It makes no economic sense to join

an industry that doesn’t safeguard its own future though.

THE BIGGEST ISSUE IN THE

SOUTHERN STATES IS THE

DOMINATION OF THE ROOFING

INDUSTRY BY ROOF TILES.

METAL ROOFING 101

PETER COLL